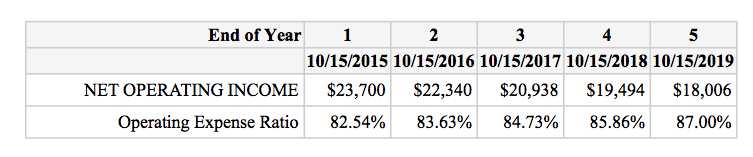

Measures of decline in total renter households from 2016 to 2018 vary widely by Census Bureau survey, ranging from a decrease of 110,000 households in 2018, according to the Housing Vacancy Survey (HVS), to 459,000 from the American Community Survey (ACS) in 2017, the most recent data available. More investor dollars flowed into apartments than any other property sector with total transaction volumes up 9.6 percent year-over-year, according to Real Capital Analytics. Concerns about overbuilding are continually met with reports of record-breaking absorption levels, decreasing vacancy and persistently strong rent growth. When building a multi-year proforma it can also be helpful to calculate the operating expense ratio for each year in the holding period in order to quickly spot and quantify trends in operating expenses relative to income.Following a year of moderate growth and solid fundamentals in 2018, the first six months of 2019 make that past year seem like a lull for the apartment industry. It gives an indication of how much of a property’s income is consumed by operating expenses. In this short article we covered the operating expense ratio, which is a helpful calculation used in the analysis of commercial real estate. For example, if a property is poorly managed then vacancy will likely be higher than it should be, and therefore including vacancy in the operating expense ratio will give an indication of this.

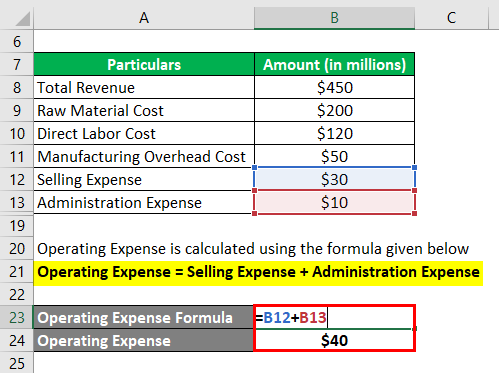

Since managing vacancies is part of operating a property efficiently, including this in the operating expense ratio might make sense. Why include vacancy in the operating expense ratio? This can be useful when you want to measure how efficiently a property is being managed. Effective rental income is just potential rental income less any vacancy and credit losses. Sometimes you might also see the operating expense ratio calculated using effective rental income instead of potential rental income. By calculating the operating expense ratio for each year in the holding period, we can quickly spot and quantify this trend at a glance. Now, let’s further suppose that we have a 5 year proforma that looks like this:īy calculating the operating expense ratio for each year in the holding period, we can quickly spot a trend in the total expenses as they relate to potential rental income.Īs you can see from the calculations above, the operating expenses for this property increase faster than our potential rental income does, which causes our operating expense ratio to increase over the holding period. Here’s how we’d calculate an operating expense ratio for this property: Suppose we have potential rental income of $100,000 and total operating expenses of $45,000.

Operating expense ratio how to#

Let’s take an example to illustrate how to calculate the operating expense ratio. When building a multi-year proforma, it can often be helpful to calculate an operating expense ratio for each year in the holding period in order to spot trends in total operating expenses, relative to potential rental income. The operating expense ratio formula measures how much of a property’s potential rental income is consumed by expenses needed to operate the property. Operating Expense Ratio Definitionįirst of all, what exactly is the operating expense ratio? The operating expense ratio is simply the total of all expenses needed to operate a property divided by the potential rental income for a property. Here’s the operating expense ratio formula: The operating expense ratio is a simple ratio that’s easy to calculate and in this article we’ll take a closer look at how to calculate the operating expense ratio, how to interpret it, and finally we’ll tie it all together with a solid example. The operating expense ratio provides a lot of useful insight into a commercial property analysis, but it’s not as widely used as it ought to be.

0 kommentar(er)

0 kommentar(er)